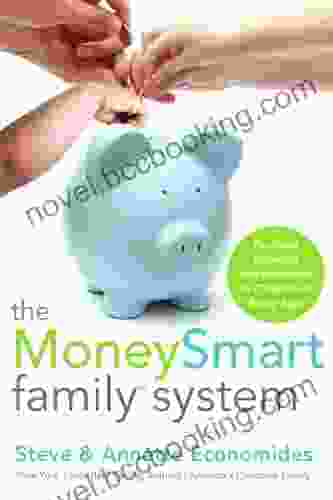

Teaching Financial Independence To Children Of Every Age: The Ultimate Guide to Empowering Your Kids

: The Importance of Financial Literacy for Children

In today's rapidly evolving world, financial literacy has become an essential life skill for children of all ages. With the abundance of financial information and products readily available, it is more important than ever to equip our children with the knowledge and skills they need to navigate the increasingly complex financial landscape.

4.5 out of 5

| Language | : | English |

| File size | : | 1845 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 273 pages |

Teaching financial independence to children empowers them to make informed decisions about their money, develop a positive financial mindset, and set themselves up for financial success in the future. By providing them with a solid foundation in financial principles, we can help them avoid the pitfalls of debt, save effectively, and plan for their financial future.

Early Years: Laying the Foundation for Financial Responsibility

The early years (ages 3-7) are a crucial time to introduce children to basic financial concepts. Through play, storytelling, and real-life experiences, you can help them understand the value of money, the importance of saving, and the difference between needs and wants.

- Introduce the concept of money: Explain how we use money to buy things and talk about different coins and bills.

- Create a simple budget: Help your child track their income (allowance or gifts) and expenses to teach them about managing money.

- Encourage saving: Set up a piggy bank or savings account and encourage your child to save a portion of their money.

Elementary School: Building Financial Skills

As children enter elementary school (ages 8-12),their financial knowledge and skills should continue to expand. This is a great time to teach them about budgeting, investing, and the importance of financial planning.

- Create a more detailed budget: Involve your child in creating a budget that includes income, expenses, and savings goals.

- Introduce basic investing: Teach your child about different types of investments, such as stocks and bonds, and how they can grow their money over time.

- Discuss financial planning: Talk about the importance of setting financial goals, creating a savings plan, and protecting your money.

Middle School: Mastering Financial Decision-Making

In middle school (ages 13-15),children begin to make more independent financial decisions. This is a crucial time to help them develop critical thinking skills and learn to make informed choices.

- Teach about credit and debt: Discuss the different types of credit, how to use credit responsibly, and the consequences of debt.

- Introduce financial risks: Talk about different types of financial risks, such as market fluctuations and inflation, and how to mitigate them.

- Encourage financial goal-setting: Help your child set financial goals, develop a plan to achieve them, and monitor their progress.

High School: Preparing for Financial Independence

High school (ages 16-18) is the perfect time to prepare your child for financial independence. This is when they start making important financial decisions, such as choosing a college, getting a job, and managing their finances on their own.

- Discuss college financing: Help your child understand the different options for paying for college, such as scholarships, grants, loans, and work-study programs.

- Introduce financial aid: Teach your child about different types of financial aid, such as FAFSA and Pell Grants, and how to apply for them.

- Encourage career exploration: Help your child explore different career options, research salaries, and develop a plan for their financial future.

Tips for Teaching Financial Independence to Children

- Start early: The sooner you start teaching your child about money, the better.

- Make it fun: Use games, activities, and real-life examples to make learning about finances enjoyable.

- Be patient: Teaching financial literacy takes time and effort. Don't get discouraged if your child doesn't grasp a concept right away.

- Be a good role model: Children learn by watching the adults in their lives. Set a good example by managing your own finances responsibly.

- Seek professional help if needed: If you're struggling to teach your child about finances, don't hesitate to seek help from a financial advisor or educator.

: Raising Financially Responsible Children

Teaching financial independence to children is a gift that will benefit them throughout their lives. By providing them with the knowledge and skills they need to make informed financial decisions, we can help them achieve financial success and live financially secure lives. Remember, financial literacy is a lifelong journey, and the lessons you teach your children today will lay the foundation for their financial future.

About the Book

Teaching Financial Independence to Children of Every Age is a comprehensive guide that empowers parents, educators, and guardians with the tools and strategies they need to teach children of all ages about money. This book is filled with practical advice, engaging stories, and real-life examples that make financial literacy fun and accessible for kids. With its age-appropriate approach and expert guidance, Teaching Financial Independence to Children of Every Age is the definitive resource for anyone who wants to raise financially responsible children.

Free Download your copy today!

4.5 out of 5

| Language | : | English |

| File size | : | 1845 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 273 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Rex A Sinquefield

Rex A Sinquefield Vincent J Monastra

Vincent J Monastra Richard A Crooker

Richard A Crooker Lisa Strattin

Lisa Strattin Simon Schama

Simon Schama Rui Zhi Dong

Rui Zhi Dong Robin Suerig Holleran

Robin Suerig Holleran Sakari Howell

Sakari Howell Tod Benoit

Tod Benoit Rod Vick

Rod Vick Sarah Dry

Sarah Dry Rita Dresken

Rita Dresken Soli Lazarus

Soli Lazarus William C Cline

William C Cline Ron Lemaster

Ron Lemaster Robert Thurston

Robert Thurston Tim Severin

Tim Severin Rowland B Wilson

Rowland B Wilson Vishal Gupta

Vishal Gupta Thema Bryant Davis

Thema Bryant Davis

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Ralph TurnerGeorge, Martha Washington, Presidents, and First Ladies: A Journey Through...

Ralph TurnerGeorge, Martha Washington, Presidents, and First Ladies: A Journey Through...

Don ColemanUnlocking the Enigmatic Figure of John the Baptist: A Journey into the Depths...

Don ColemanUnlocking the Enigmatic Figure of John the Baptist: A Journey into the Depths... Geoffrey BlairFollow ·15k

Geoffrey BlairFollow ·15k Braden WardFollow ·5.7k

Braden WardFollow ·5.7k Jeremy MitchellFollow ·17.5k

Jeremy MitchellFollow ·17.5k Chase SimmonsFollow ·3.3k

Chase SimmonsFollow ·3.3k Drew BellFollow ·11.8k

Drew BellFollow ·11.8k Richard AdamsFollow ·6.5k

Richard AdamsFollow ·6.5k Milan KunderaFollow ·12.6k

Milan KunderaFollow ·12.6k Ted SimmonsFollow ·14.5k

Ted SimmonsFollow ·14.5k

Steven Hayes

Steven HayesEmbark on Unforgettable Adventures: Discover the Best of...

Unveiling the Enchanting Trails of the...

Jarrett Blair

Jarrett BlairMaster the Road: Ace Your North Carolina Driver's Test...

Unlock the Secrets to...

Brent Foster

Brent FosterDk Essential Managers Understanding Accounts: Your...

In today's...

Isaac Mitchell

Isaac MitchellPrognosis: A Memoir of My Brain - A Journey of Hope and...

In 2013, Eve Ensler was diagnosed with a...

4.5 out of 5

| Language | : | English |

| File size | : | 1845 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 273 pages |